Answers for every forecast, variance, and risk

Connect ledgers, automate financial dashboards, and export investor-ready decks without leaving one secure workspace.

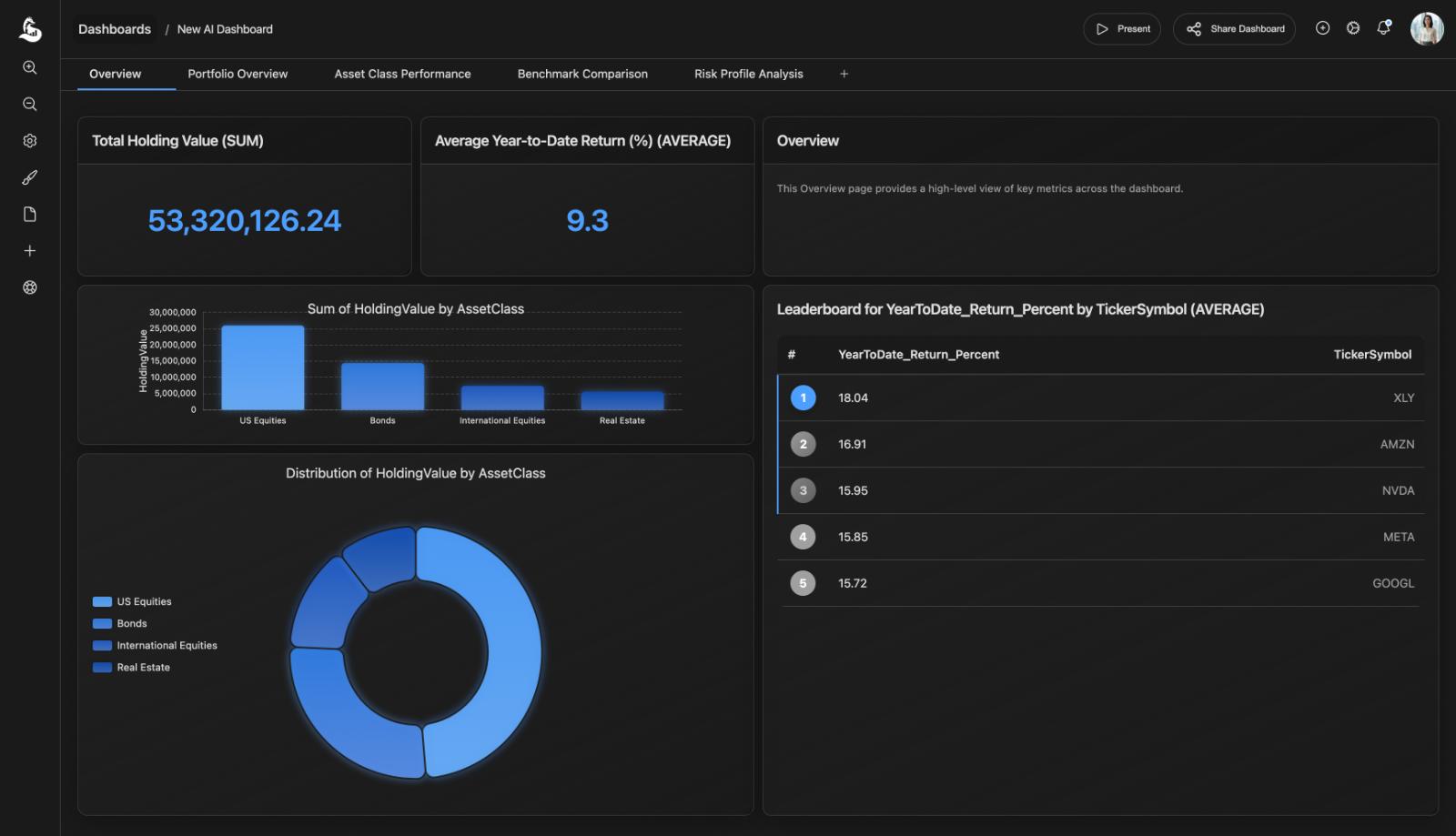

Finance AI command center

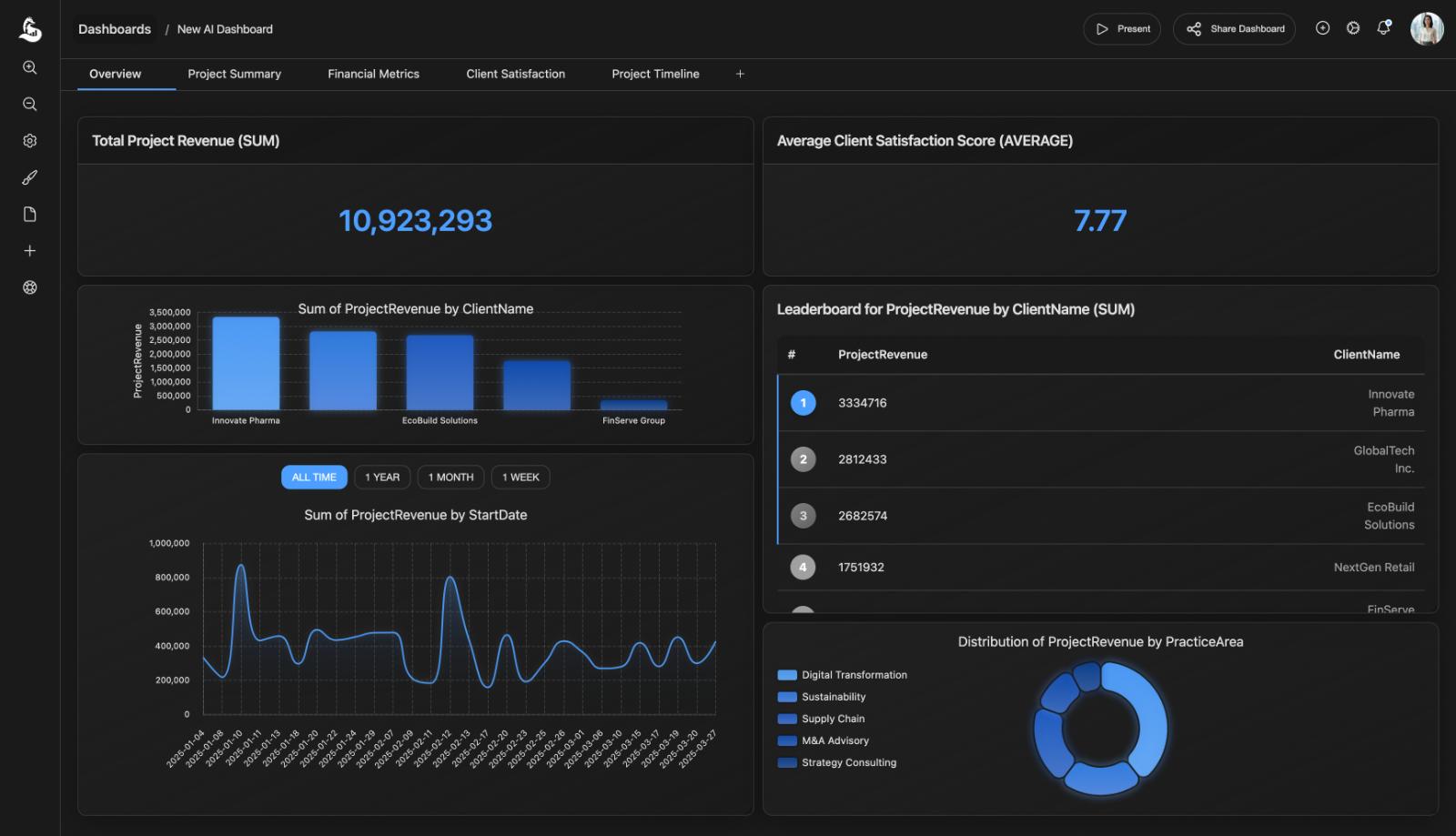

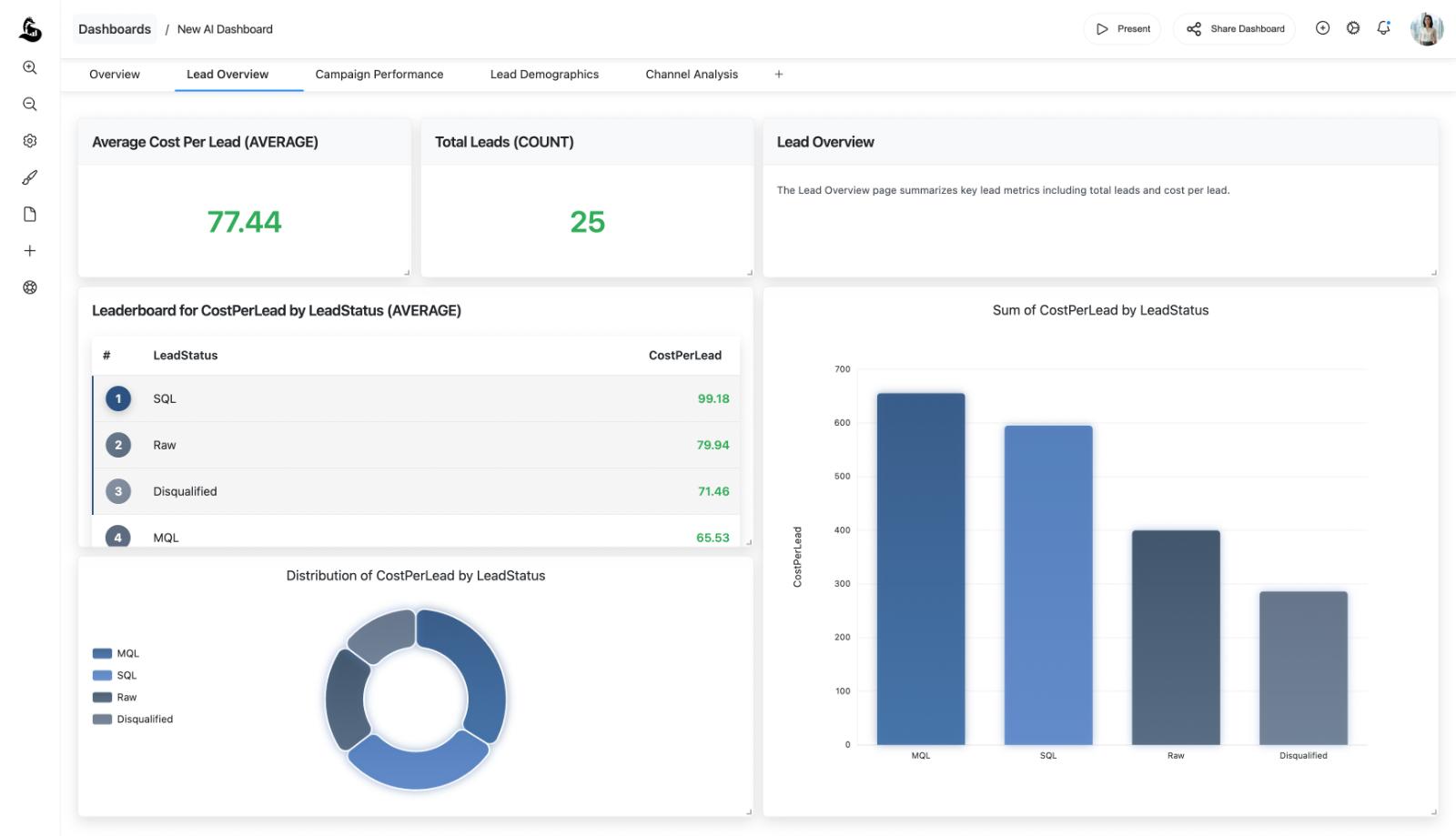

Run CFO reporting, FP&A, and treasury operations from one hub

Stream ERP, CRM, and revenue data into a finance dashboard that recalculates scenarios the moment numbers change.

Explain budget vs actual with ai reporting, executive summaries, and KPI storytelling tailored to board conversations.

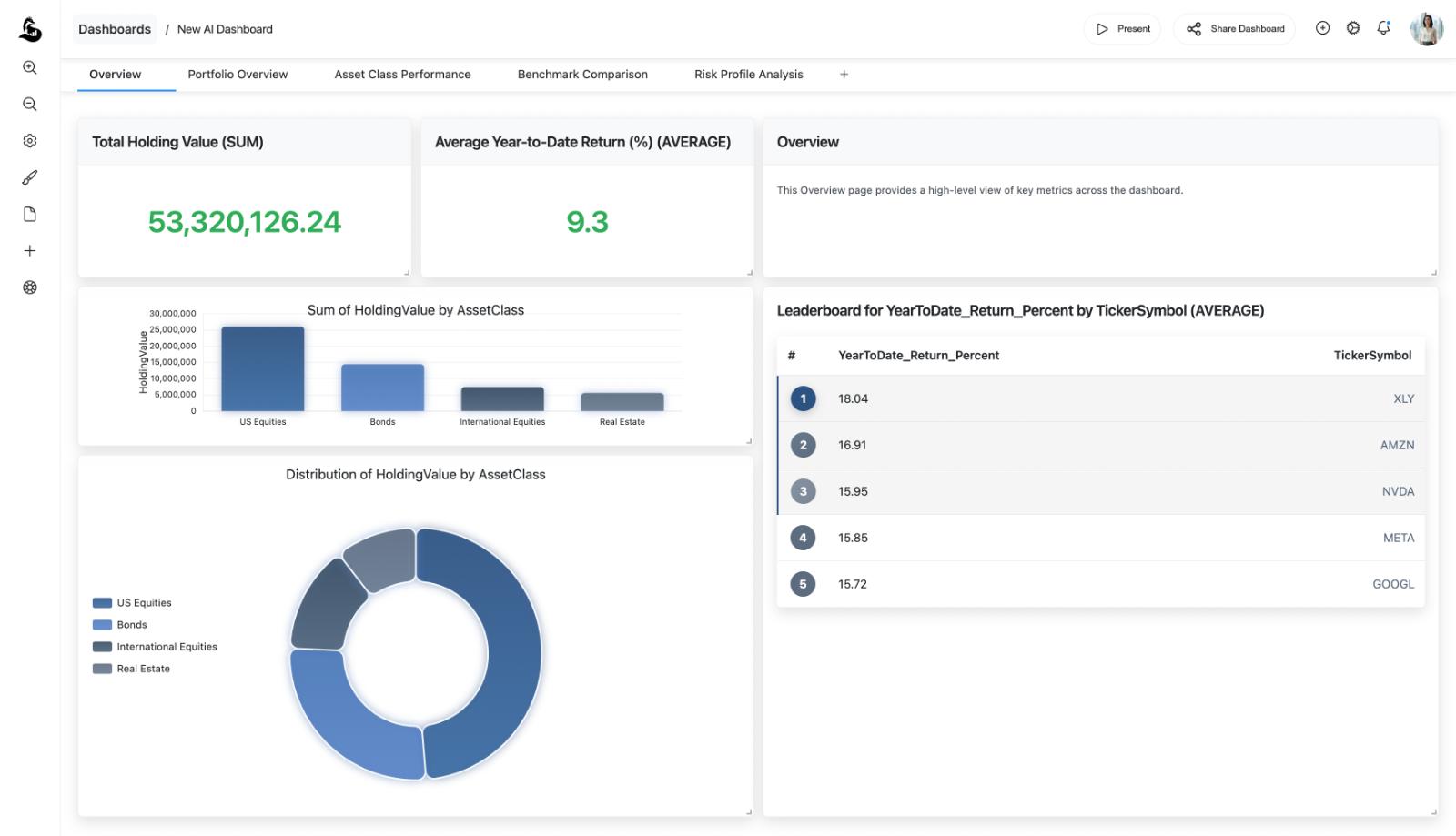

Ask "What if churn rises 2%?" and AutoML delivers revenue, cash, and runway outlooks with mitigation plans.

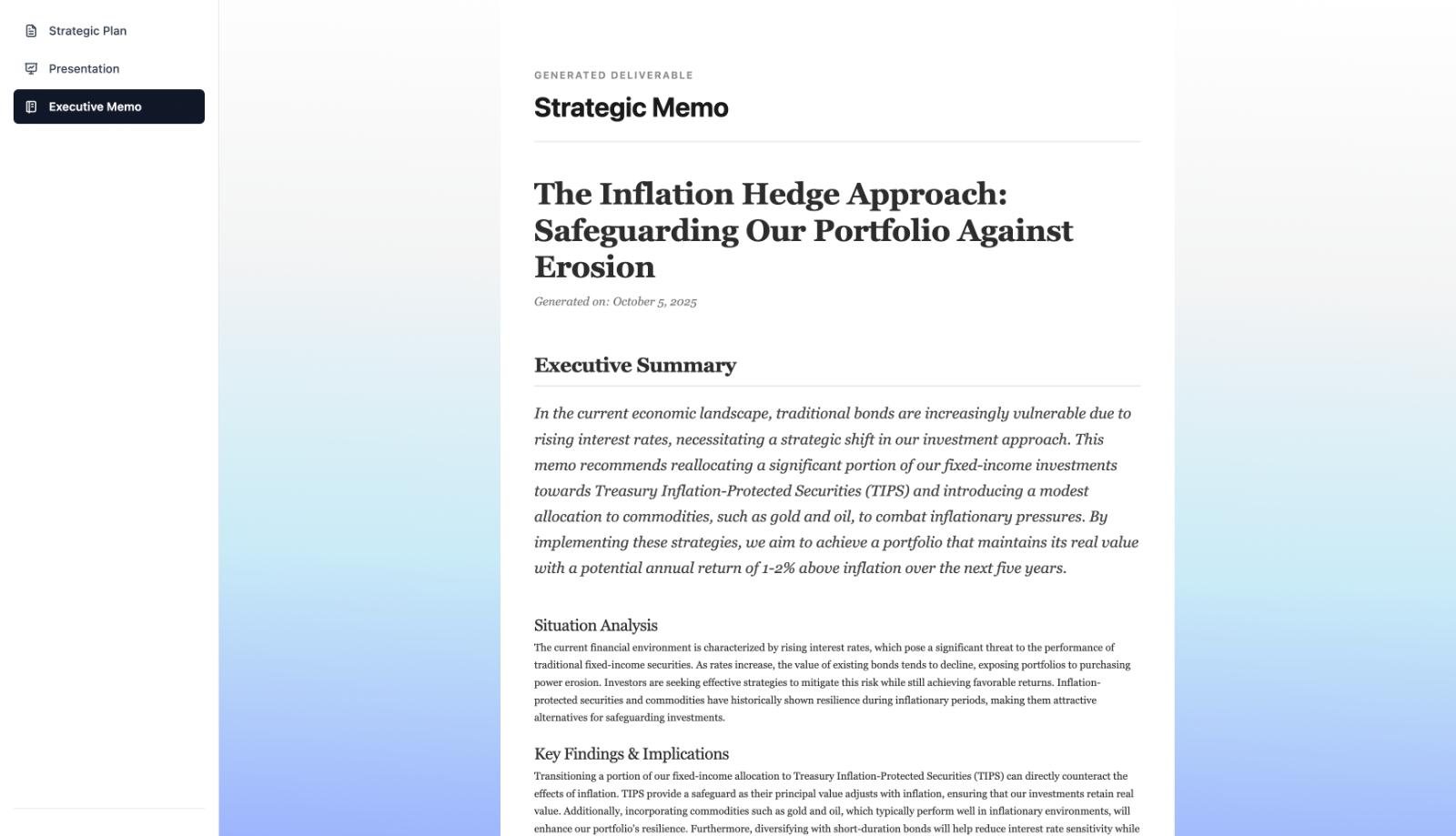

From ledger to leadership slides

Close the books and brief stakeholders in one flow

The finance AI command center transforms ledger data into CFO dashboards, finance decks, and investor memos that stay in sync. Automate narrative analytics, highlight risk, and keep compliance teams confident that every statement is audit-ready.

Prompt Library

Prompts and follow-ups for finance automation

Prompt: Draft the weekly FP&A update for leadership.

Follow-up: Highlight forecast shifts, cost drivers, and executive recommendations.

Prompt: Model cash runway scenarios for the next three quarters.

Follow-up: Compare base, upside, and downside cases with mitigation plans.

Prompt: Explain variance versus budget for Q2.

Follow-up: Tag department owners, show trend visualizations, and provide board-ready commentary.

Prompt: Generate an investor FAQ for the upcoming funding round.

Follow-up: Attach financial statements, KPIs, and finance AI insights.

Prompt: Build a budget expansion request.

Follow-up: Include predicted ROI, payback period, and scenario-based sensitivity.

Prompt: Prepare an audit-ready compliance pack.

Follow-up: Surface evidence, approvals, and timeline checkpoints for auditors.

Finance & FP&A Insights

Explore finance AI strategies for forecasting, variance analysis, and compliance-ready reporting.

Frequently Asked Questions

Have questions? We have answers. If you can‘t find what you‘re looking for, feel free to contact us.

Finance dashboards pull data from Snowflake, NetSuite, Workday, and CRM exports, keeping a finance AI single source of truth up to date.

Can we connect ERP, CRM, and data warehouse sources without rebuilding pipelines?

Scheduled refreshes, API syncs, and manual uploads are all supported so FP&A, treasury, and accounting teams can collaborate on the same insights.

Every forecast, presentation, and memo comes with lineage, approvals, and audit-ready logs that satisfy SOX, GAAP, and investor requirements.

Will auditors and leadership trust the generated narratives and models?

Finance governance features lock brand kits, control prompts, and capture evidence so audit teams have full transparency.

Prompt-driven dashboards and finance deck templates adapt tone and depth automatically while preserving accurate figures.

How easy is it to generate different views for board members, investors, or department heads?

Variants for investor relations, department reviews, and executive briefings can be produced in minutes without manual reformatting.

AutoML-powered forecasts offer quick, balanced, and comprehensive modes, surfacing revenue, margin, and cash impacts side-by-side.

Can we compare multiple cases for the board before choosing a path?

Each scenario is exportable to board decks, finance dashboards, and memo templates so stakeholders agree on the plan.

Projects provide comment threads, version history, and finance automation hooks so teams can review, approve, and execute together.

How do controllers, FP&A analysts, and CFOs work in one AI workspace?

Role-based permissions keep sensitive statements secure while enabling cross-functional feedback loops.

Out-of-the-box finance AI templates cover close reporting, board decks, variance analysis, and investor relations updates.

Are there finance prompt libraries and templates we can start with?

Prompt starter packs and finance workflows accelerate adoption, letting teams deliver their first executive-ready outputs in days.